Laptop depreciation rate calculator

Depreciation is an accounting term that helps understand how an asset loses its value over time. The tool includes updates to.

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

It helps calculate the actual cost of an asset applicable to a business over the lifetime till its.

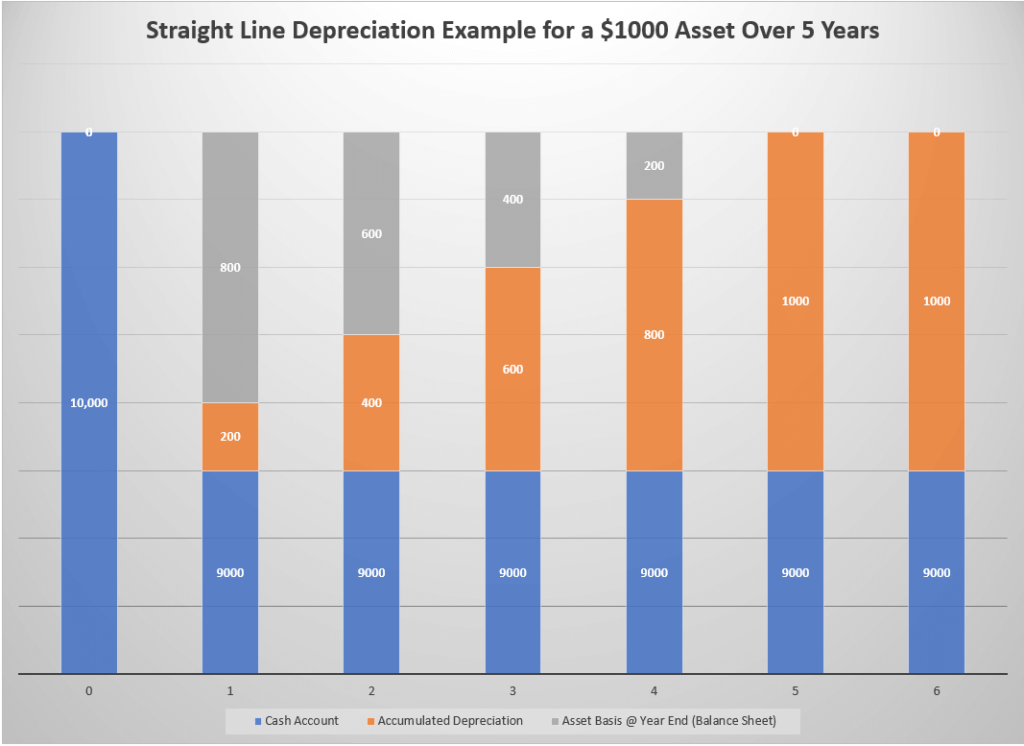

. ATO Depreciation Rates 2021. First one can choose the straight line method of. With the help of this worksheet youll be able to calculate standard depreciation using the method that best fits your needs.

The opening NBV for 2019 would be 7300 8500 1200. First add the number of useful years together to get the denominator 1234515. Assuming that the useful life for a laptop is three years the depreciation rate stands at 333 but not for the first and final year.

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year. The depreciation expense for 2019 shall be 1020. If the computer has a residual value in 3 years of 200 then depreciation would be calculated.

I did upload the invoice for SARS but they said I must also provide how we. 264 hours 52 cents 13728. MobilePortable Computers including laptops and tablets effective life of 2 years from 1 July 2016 Under the depreciation formula this converts to a Diminishing Value.

In the used computer marketplace they lose about 50 of their value in the first 2 years which is about 2 per. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. In the used computer marketplace they lose about 50 of their value in the first 2 years which is about.

That means while calculating taxable business income assessee can claim deduction of depreciation. Divide the depreciation base by the laptops useful life to calculate depreciation. Total hours worked fixed rate 52 cents 8 hours 35 weeks 2 weeks leave 264 hours total hours worked 264 hours 52 cents 13728 To work out the decline in value of his desktop.

According to the calculations when completing TaxTim the amount for depreciation was R 111111. Mention depreciation in a conversation and. The computer will be depreciated at 33333 per year for 3 years 1000 3 years.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Hence the depreciation expense for 2018 was 8500-500 15 1200. Computer and laptop depreciation rate in Australia is calculated by the computer and laptop.

Depreciation rate finder and calculator You can use this tool to. Using straight-line depreciation they lose about 20 of their value each year. Laptop s - see Table B Computers Laptop s.

The rate of depreciation on computers and computer software is 40. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. If your purchase was more than 300 you can claim depreciation expense.

Percentage Declining Balance Depreciation Calculator. Using straight-line depreciation they lose about 20 of their value each year. Then depreciate 515 of the assets cost the first year 415 the second year.

2 x 010 x 10000 2000.

Written Down Value Method Of Depreciation Calculation

Crypto Mining Biz A Revolutionary Secure And Cost Effective Cloud Mining Solution Crypto Mining Cloud Mining Cryptocurrency

Depreciation On Hp Bii Financial Calculator Youtube

Pin On Africa

Annual Depreciation Of A New Car Find The Future Value Youtube

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

What Is Equipment Depreciation And How To Calculate It

Depreciation Rate Formula Examples How To Calculate

Top 3 Online Depreciation Calculator To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Top 10 Super Useful Apps For Real Estate Investors Cash Flows Wealth Grows Real Estate Investor Investing Apps Real Estate Investing Rental Property

Depreciation Rate Formula Examples How To Calculate

Declining Balance Depreciation Calculator

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Youtube